What is the Golden Visa via Property Investment

The UAE’s Golden Visa is a long-term residence permit (usually valid for 10 years) designed to attract investors, entrepreneurs, and skilled professionals. One of the most popular routes is through real estate investment, including off-plan properties — properties that are still under construction but legally registered and approved.

Step-by-Step Roadmap: From Off-Plan to Golden Visa

| Step | What to Do | Key Documents / Proofs | Timing & Considerations |

| 1. Select an Off-Plan Project & Developer | Choose a trusted, government-approved developer and ensure the project is officially registered. | Developer’s registration, project documents, and Sales Purchase Agreement (SPA). | Always verify approvals and project status to avoid delays. |

| 2. Ensure the Investment Meets the Minimum Threshold (AED 2 million) | Your property (or combined properties) must have a total value of at least AED 2 million. | SPA, valuation certificate, title deed (if available), and payment receipts. | The AED 2 million threshold applies for both off-plan and ready properties. |

| 3. Confirm Ownership Structure & Equity | If mortgaged, your paid-up share (equity) must meet the value requirement. For joint ownership, your share must reach AED 2 million to qualify individually. | Mortgage agreement, bank No-Objection Certificate (NOC), payment records. | Ensure you can prove your actual investment portion. |

| 4. Complete Payments According to the Schedule | Maintain timely payments as per your SPA. Keep all receipts and proof of transfers. | SPA, proof of payments, escrow confirmation. | Being up-to-date with payments is crucial to eligibility. |

| 5. Prepare Supporting Documents | Gather general requirements: valid passport, visa or entry permit, health insurance, and good conduct certificate. | Passport, insurance, police clearance, identity and address proof. | Make sure all documents are current and attested if needed. |

| 6. Apply for the Golden Visa | Submit your application through ICP, DLD, or the local authority. Pay the required fees. | Full application set, property documents, identification, and NOCs. | Processing time may vary from a few weeks to a few months. |

| 7. Maintain Eligibility After Approval | Keep your property ownership active and comply with visa terms. Selling too soon may affect your visa. | Updated property and insurance documents. | Always verify renewal and ownership conditions. |

Eligibility Criteria (2026 Update)

- Minimum investment: AED 2 million in property (single or multiple units).

- Property type: Ready or off-plan properties both qualify.

- Mortgaged property: Eligible if your paid-up equity meets the value threshold and a bank NOC is provided.

- Ownership: Must be under the applicant’s name. For joint owners, each individual’s share must meet the minimum if applying separately.

- Developer approval: The project must be from a registered and recognized developer.

- Other documents: Valid passport, health insurance, and a clean criminal record are mandatory.

Recent Key Changes

- The minimum down payment requirement for mortgaged properties has been removed in most cases.

- Off-plan properties can now qualify even before reaching 50% construction completion.

- Market valuation from the Land Department or developer is now accepted as proof of value.

Common Mistakes to Avoid

| Mistake | Why It Causes Problems | How to Avoid It |

| Choosing an unapproved developer or project | The property won’t qualify for visa purposes. | Always verify developer registration and approvals. |

| Misunderstanding payment requirements | Insufficient payments may disqualify you. | Keep receipts and confirm total paid value meets AED 2 million. |

| Assuming old rules still apply | Rules about construction completion and mortgage limits have changed. | Always check the latest requirements before applying. |

| Incomplete or unverified documents | Missing attestations can delay or reject your application. | Use a checklist and get documents professionally attested. |

| Selling property too early | The visa may be revoked if ownership ends. | Keep the property until you fully understand renewal terms. |

Estimated Timeline

- Select and Book Property – 1–2 weeks

- Sign SPA and Make Payments – 2–4 weeks

- Off-Plan Registration (Oqood, etc.) – up to 1 month

- Prepare and Submit Visa Application – 2–8 weeks

- Receive Golden Visa UAE – typically within 1–3 months after approval

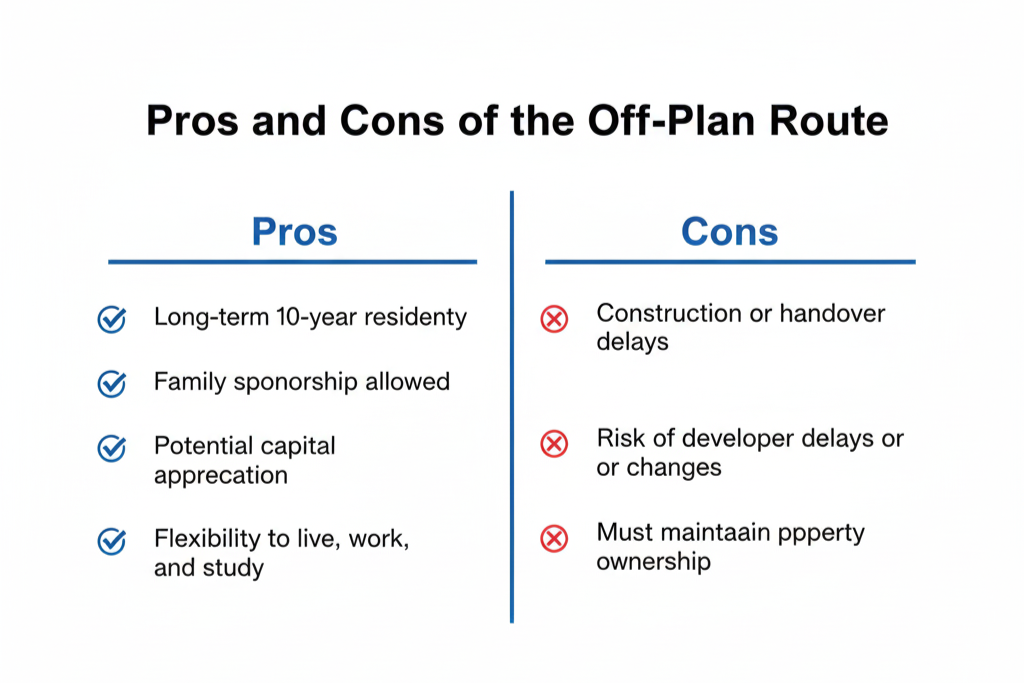

Pros and Cons of the Off-Plan Route

Quick Checklist Before You Commit

✅ Developer is reputable and project is registered

✅ SPA and payment plan are clear and secure

✅ Total property value meets AED 2 million requirement

✅ All payments documented and receipted

✅ Bank NOC available (if mortgaged)

✅ Personal documents up to date and attested

✅ Understand ownership and visa renewal conditions

Final Thoughts

Investing in Dubai’s off-plan property market is not only a path to long-term financial growth but also a direct gateway to residency through the UAE Golden Visa. With updated rules making it easier for investors to qualify, now is one of the most favorable times to turn your property investment into a secure, long-term future in the UAE.

Work With Dubai’s Trusted Real Estate Experts

At Serendib Realty, we help investors navigate every step of the Off-Plan to Golden Visa journey — from choosing the right property and developer to completing your documentation for residency approval.

– Direct access to top UAE developers

– End-to-end assistance — investment, paperwork, and visa guidance

– Trusted advisors for local and international investors

Contact Serendib Realty today to find the perfect off-plan investment that not only grows your wealth but also secures your UAE Golden Visa.