If you’ve been keeping an eye on the Dubai housing market, you already know it’s anything but dull. Numbers bounce, stories shift, and sentiment sways between “this is a boom” and “caution ahead.” Most importantly, 2025 set the stage for how 2026 is shaping up

Both in pricing and in people’s expectations.

Let’s break down the latest trends that matter for buyers, investors, and anyone trying to make sense of where Dubai’s housing sector is heading.

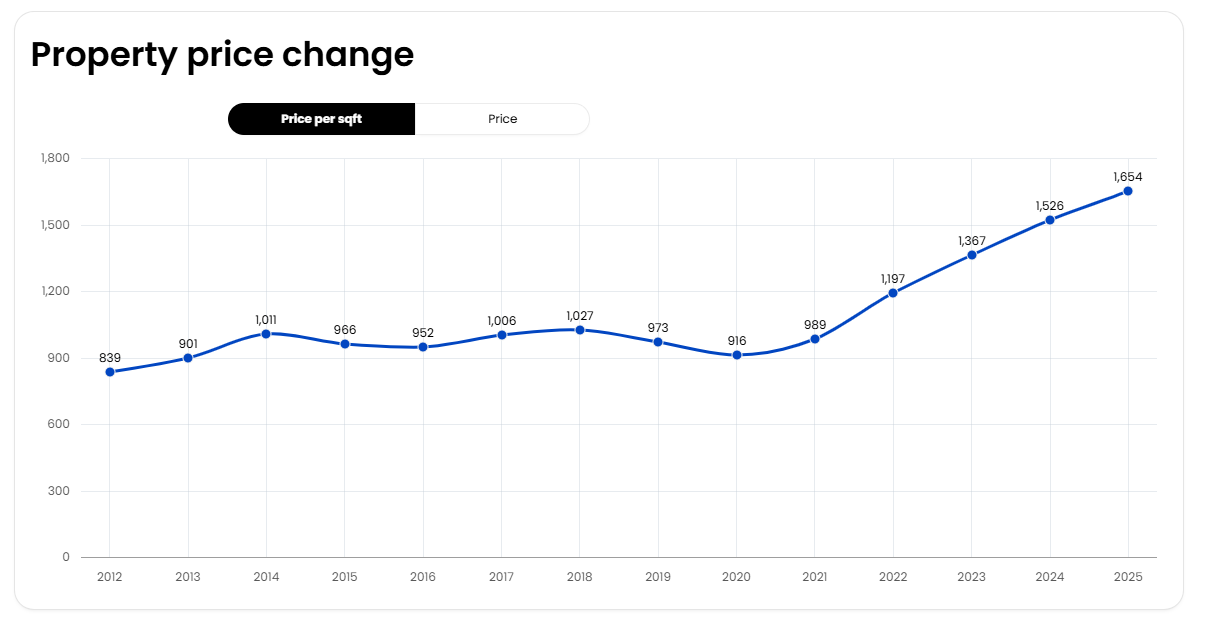

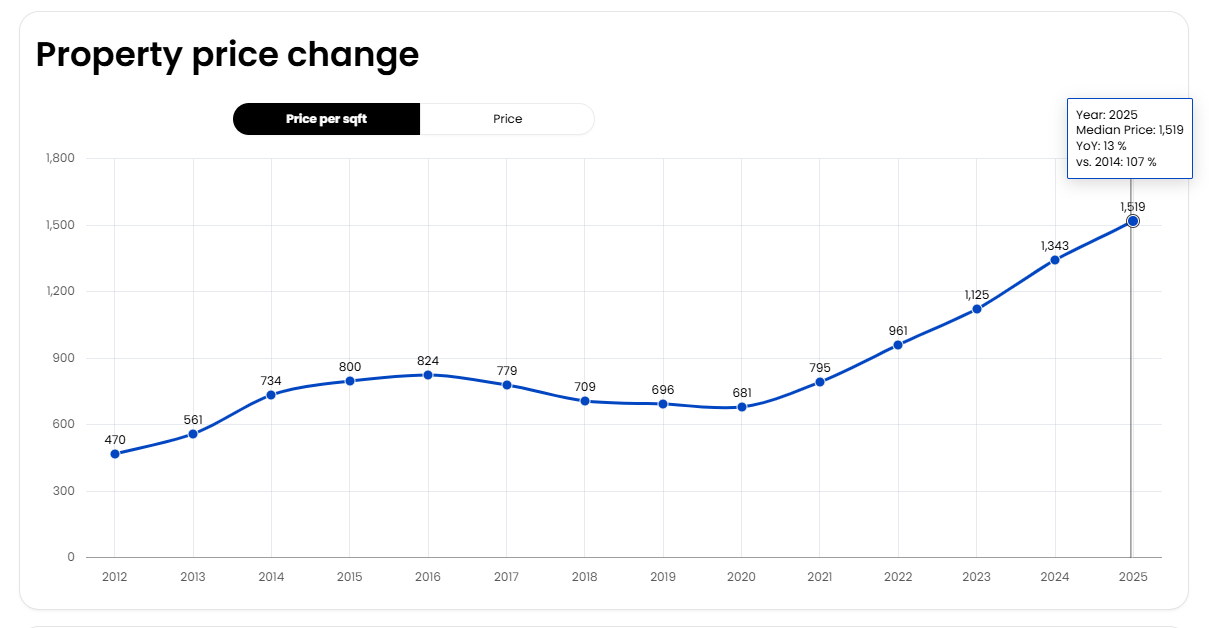

Price Movements: Growth With a Hint of Adjustment

Call it steady progress, or warming up after a long replay — but overall, prices have climbed significantly over recent years. According to recent real estate data, average property prices in Dubai were around AED 1,650 per sq ft by early 2025, marking a noticeable uptick from prior years. Apartment prices had risen around 8% year-on-year.

This continued momentum is mirrored elsewhere. Analyses from local sources suggest villa prices in mid-tier communities increased 13–25%, supported by new handovers and strong buyer interest.

Here’s the interesting thing

Strong growth doesn’t mean uniform growth. Some luxury segments and high-demand suburbs like Palm Jumeirah and Downtown Dubai remained resilient with pricing power, while districts with heavier upcoming supply might feel cooling pressure.

Now, a few corrections are projected. Ratings agencies like Fitch have warned that a supply surge through 2026 could lead to price adjustments, possibly dipping up to around 15% in certain segments as the market absorbs new units.

So, growth is real, but it’s nuanced. Buyers might find pockets of exceptional value even as overall numbers stay healthy.

Transaction Activity: Still Steady and Strong

Transaction volumes tell a part of the story that price tags don’t always show.

Dubai’s property market wasn’t quiet in 2025. On the contrary, it posted some of its strongest figures on record: more than 98,700 transactions worth AED 327 billion were completed in just the first half of the year.

Mid-market properties played a particularly important role, driving over half of the deals in some quarters, and demonstrating that growth isn’t limited to ultra-premium listings.

In other words, it’s not only wealthy investors making moves. Everyday buyers and end users are actively shaping demand patterns — and that tends to support longer-term sustainability.

Supply vs Demand: The Balancing Act

Here’s where things get interesting.

Dubai isn’t short on new housing stock. Estimates suggest around 73,000 new homes will be delivered in 2025 alone, and the emirate aims for roughly 120,000 units in 2026 alone is coming as new supply.

Yet, the actual impact of this supply depends on how fast it’s absorbed. Recent market commentary highlights substantial new completions: tens of thousands of units were delivered in 2025.

At the same time, population growth.

Now approaching roughly 4 million residents and rising and continues to underpin housing demand.

So yes, supply is increasing, but so is demand. In many mature communities, occupancy rates remain high, suggesting that the market isn’t flooded but rather stretched to meet real needs.

Still, the balance between how much is built and how quickly it’s occupied will likely play a defining role for prices and rents in 2026.

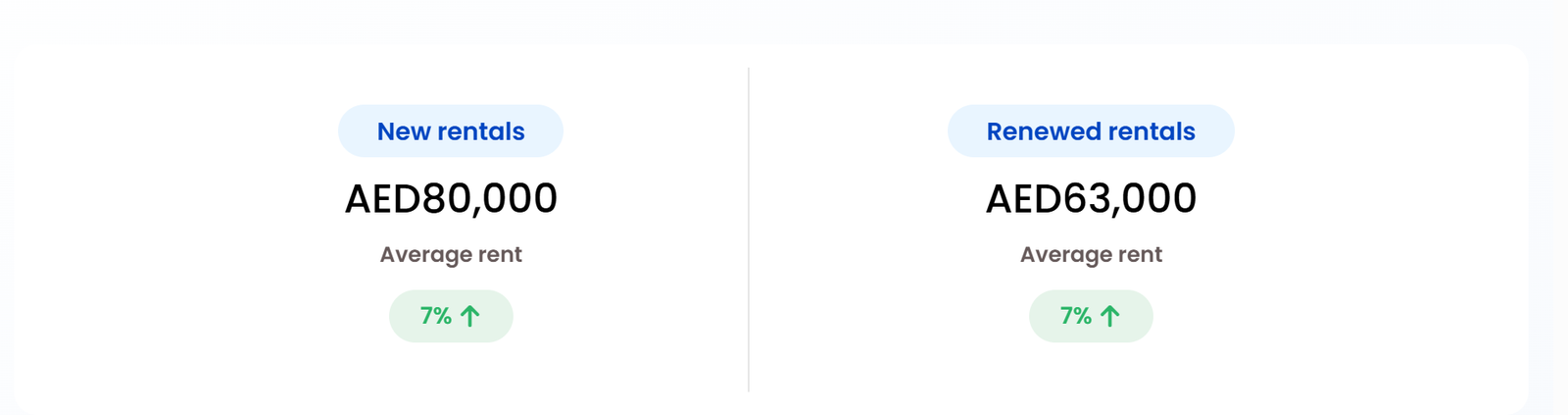

Rental Market: Yields That Still Turn Heads

You know what investors love? Predictable rental yields. Dubai still delivers those.

According to recent market reports, gross rental yields for apartments routinely sit in the mid-to-high single digits, often between 6% and 10% in key communities.

That’s especially attractive compared to many global cities, where yields often fall below 5%. Even villas, while typically yielding a bit less than apartments, offered strong returns in established communities in the past year.

Here’s a small twist though: rental growth patterns aren’t uniform. Affordable and mid-market segments saw some of the strongest rent gains, partly because demand for family-friendly, accessible housing remains robust.

And in 2026, forecasts suggest that rents may continue rising,

Though perhaps at a calmer rate of around 6% on average across the city rather than the double-digit spikes seen in some previous years.

Where Buyers Are Looking and Why

One lesson from recent trends is that demand isn’t evenly spread.

Communities with lifestyle appeal, connectivity, and reasonable pricing

Think Jumeirah Village Circle, Dubai South, and International City have remained hot.

Luxury hubs like Palm Jumeirah, Downtown Dubai, and Business Bay still draw premium interest, though their yields can be a bit more modest because prices are high.

That said, when buyers pause, it’s usually over value perception rather than fundamentals. Quality locations with tight supply tend to outperform broader averages.

What the Forecast Looks Like for 2026

Putting it all together, most analysts see 2026 as a year of refinement rather than explosion. Growth isn’t expected to evaporate, but it may become more measured.

Key points:

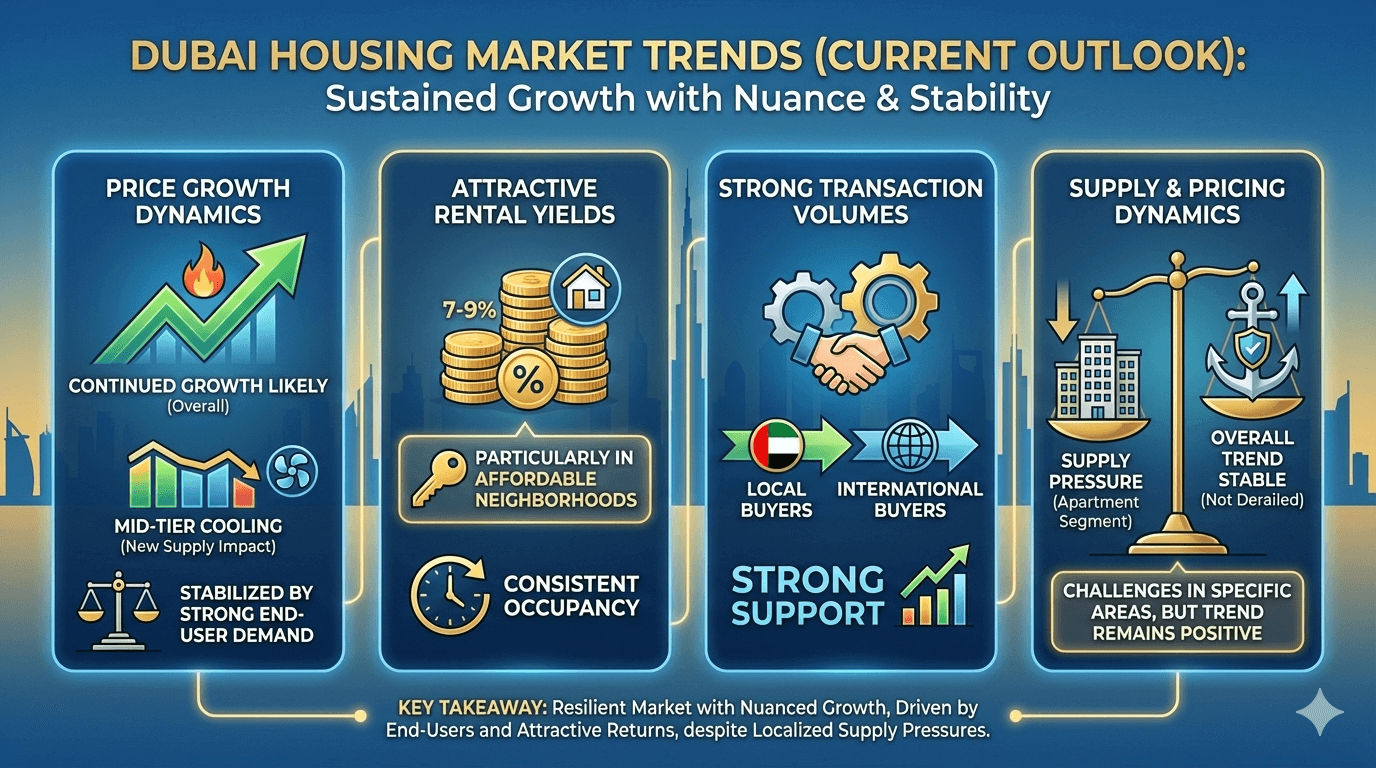

- Price growth is likely to continue, though cooling in some mid-tier segments as new units come online, and stabilized by strong end-user demand.

- Rental yields remain attractive, particularly in affordable neighborhoods with consistent occupancy.

- Transaction volumes are still strong, supported by both local and international buyers.

- Supply pressure could challenge pricing in specific area especially in the apartment segment but not derail the overall trend.

Simply put: the market isn’t falling apart; it’s maturing.

Why This Matters for Buyers

So what’s the bottom line for someone thinking about entering the Dubai housing market in 2026?

First, don’t treat it like a flash boom. It’s more like a marathon with a sprint finish, steady, competitive, and nuanced.

Second, understand your goal. If you’re buying to live, consider communities where long-term lifestyle value aligns with current pricing. If you’re investing, pay attention to rental yields, occupancy patterns, and how supply will affect next year’s returns.

Dubai’s real estate continues to be one of the most dynamic markets globally. Knowing where the data is going, and not just where it’s been, gives you an edge.

And honestly? That’s half the battle in property buying.