Dubai has long been recognized as a city of ambition, where bold ideas and visionary leadership shape its skyline and lifestyle. Over the last decade, Dubai’s real estate market has experienced explosive growth thanks to tax-friendly policies, luxury living environments, and investor-friendly policies attracting global investors.

Now in 2025, Dubai’s property market is breaking records once more. Investors looking to enter this burgeoning real estate sector must understand current trends, demand drivers, and key investment zones in order to make informed decisions. At SerendibRealty we have performed thorough analysis on current market landscape so as to assist you with making wiser choices.

2025 Property Market Breaking Records

Property sales reached all-time highs during 2024 and this trend continues in 2025, both transaction volumes and overall values reaching unprecedented heights; villas, apartments and off-plan properties all seeing robust demand.

What sets this surge apart is its diversity: not only do luxury properties trade actively in Dubai; mid-market and affordable properties also trade actively as more expatriates and long-term residents look to establish roots here. This trend not only speaks volumes for investors’ confidence in Dubai as an economic and family hub.

Investors looking for liquidity in global real estate should find an opportunity in the current environment: high sales activity ensures properties can be easily resold while rental demand guarantees steady streams of income streams.

Price and Rental Increase in Tandem

Dubai’s real estate in 2025 stands out due to the simultaneous increases in both property values and rental yields.

Property Prices

Villas located in established neighborhoods like Palm Jumeirah, Arabian Ranches and Dubai Hills have experienced notable price appreciation. Additionally, larger apartments located within Downtown Dubai and Business Bay are commanding greater values.

Rental Yields

Contrary to many international markets where rising prices erode returns, Dubai’s rental yields remain strong. Families relocating, professionals extending their stays and an active tourism sector all fuel demand for rentals in this city.

This double performance makes a winning equation for investors. Not only can you build equity through capital appreciation over time, but you’ll also reap short and medium term rental income streams.

Government Policies and Investor Confidence

Dubai’s real estate success is no accident; rather, the government continues to play an integral part in shaping the market.

Residence through Property Investment

The Golden Visa scheme remains one of the most attractive incentives for international investors. By purchasing property above a specific threshold, they and their families gain long-term residency – providing powerful incentive for anyone considering Dubai as either their second home or base of operations.

Streamlined Transactions

The Dubai Land Department (DLD) has simplified transactions through digital platforms for registration, payments and verifications that reduce bureaucracy while building investor confidence.

2025 will witness an exciting breakthrough: Tokenized Property Ownership. Thanks to government initiatives, investors are now able to buy fractional ownership in premium properties through blockchain platforms – giving smaller investors access to high-value assets without making a full commitment.

Market Trends to Keep an Eye Out for

Although the city-wide outlook is positive, individual neighborhoods’ performances differ considerably and it is essential to gain an in-depth knowledge of these micro markets in order to make the appropriate investment decision.

Luxury Waterfront Districts

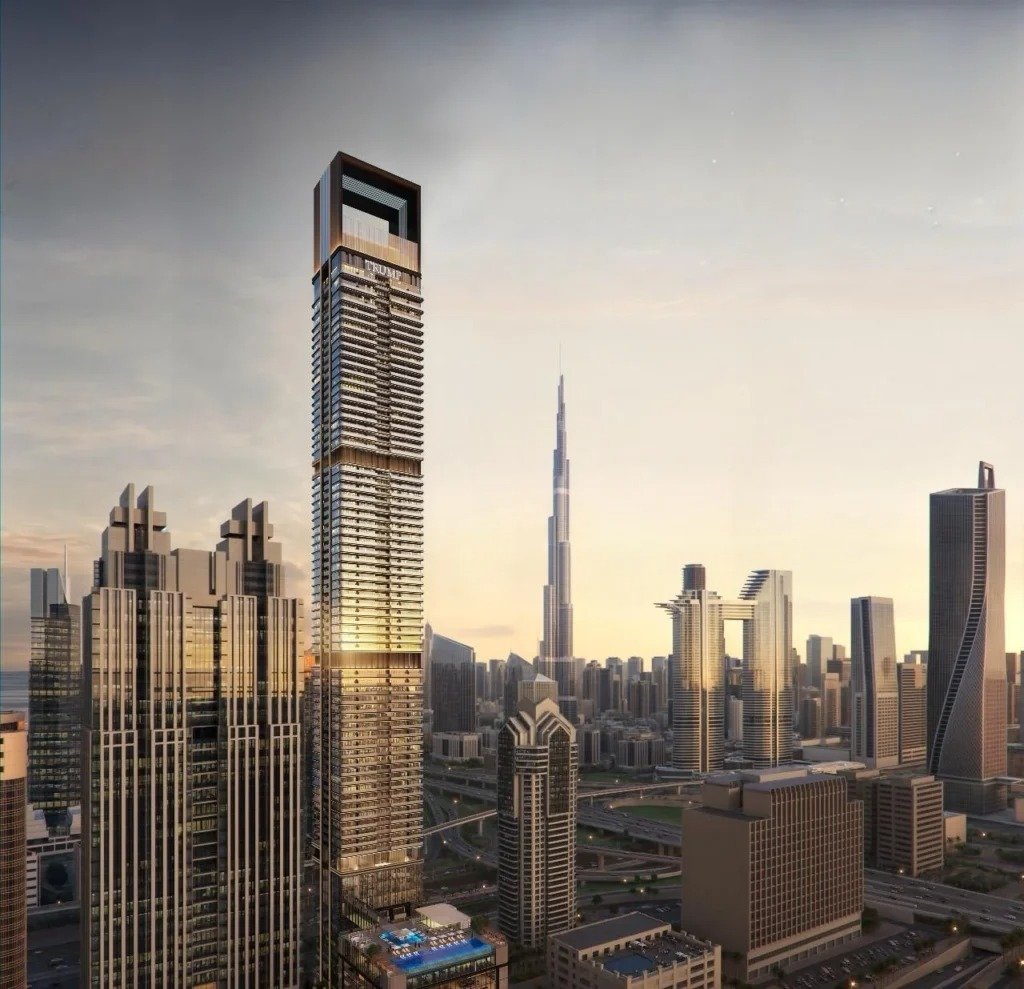

Downtown Dubai, Palm Jumeirah and Dubai Marina continue to lead in both capital appreciation and rental demand. Their international appeal, tourism-driven economy and luxurious amenities help ensure their ongoing resilience.

Family-Centric Communities

Master-planned developments such as Dubai Hills Estate, Mohammed Bin Rashid City and Arabian Ranches continue to draw families. Boasting schools, parks and retail hubs integrated into these neighborhoods, these master plans offer long-term rental stability with strong rental demand.

Emerging Growth Areas

Districts such as Dubai South and Jumeirah Village Circle (JVC) have attracted investor interest for their affordability and potential upside potential. As infrastructure improves in these regions, investors expect them to deliver significant returns over five-seven year time frames.

Opportunities and Risks in 2025

As in any market with such dynamic fluctuations, Dubai’s property sector presents both opportunities and risks.

Opportunity

-

Opportunities exist in both sales and rentals to provide investors with both capital appreciation and income streams.

-

Government-supported innovations, like tokenized property, increase accessibility and create new forms of liquidity.

-

Dubai’s global business hub status attracts expatriates and corporate tenants.

Risks

-

Global interest rate fluctuations could negatively impact mortgage affordability.

-

An excess supply in certain categories, especially smaller units, could impede yields.

-

Uncertainty surrounding global economics and geopolitics can affect capital inflows to Dubai.

Balance ambition with caution when selecting property types, developers and communities; taking into account variables like interest rates and vacancy risks can help ensure success.

Practical Guidance for Investors

At SerendibRealty, we emphasize clarity and strategy before any purchase decision. Here are some insights for 2025:

-

Make clear your goal. Are you purchasing for rental income, residence, or long-term capital appreciation? Each objective requires its own approach.

-

Prioritize quality: Reputable developers and prime locations provide added protection against volatility while guaranteeing liquidity.

-

Adopt a long-term view: Flipping properties quickly can yield returns, but owning property for 5-10 years offers greater rewards in Dubai.

-

Evaluate financing carefully: Run mortgage scenarios under stress tests for rate fluctuations and prepare a financial cushion in case rental vacancies arise.

-

Capitalize on new opportunities: Tokenized ownership offers a great way to diversify, but should only serve as an addition rather than replacement of traditional investments.

Outlook for 2025

Dubai’s real estate market in 2025 is flourishing, propelled by record sales, rising rental demand, and forward-thinking government policies. Investors find its combination of strong capital growth potential alongside attractive yields to be particularly appealing; add the benefits of residency, lifestyle appeal and innovative property ownership arrangements, and Dubai becomes one of the world’s premier destinations for real estate investment.

As the market evolves, making informed decisions becomes ever more essential. Selecting an ideal community, property type and financing model could mean the difference between an average investment and one that yields substantial returns.

At SerendibRealty, our aim is to guide investors with expertise and transparency through Dubai’s vibrant real estate scene. Whether it be a family villa, waterfront apartment or fractional ownership entry point – we are here to ensure your journey in Dubai is both safe and profitable.