Introduction

The Dubai First-Time Buyer Initiative 2025 is designed to make property ownership more accessible for both expatriates and UAE nationals. With government-backed incentives, exclusive mortgage options, and transparent processes, this initiative supports first-time buyers who are ready to invest in Dubai’s thriving real estate market.

Whether you’re searching for your first apartment in Dubai, a family villa, or looking to invest smartly, this guide covers everything you need to know—including incentives, eligibility, financing, and tips to avoid hidden costs.

Government Incentives for First-Time Home Buyers in Dubai

Through the Dubai First-Time Home Buyer Programme, buyers enjoy:

- Reduced registration fees with flexible installment options.

- Priority access to new property launches from top developers like Emaar, Nakheel, and Damac.

- Exclusive mortgage offers from leading banks, including lower interest rates and longer tenures.

- Investor-friendly benefits, including the chance to qualify for long-term Dubai residency visas (valid for 3–10 years, depending on property value).

This makes buying your first property in Dubai more affordable and attractive than ever before.

ALSO READ: Why Off-Plan Properties are Driving Dubai’s Real Estate Boom?

Eligibility for the Dubai First-Time Buyer Initiative

To qualify, buyers must:

-

Be at least 18 years old.

-

Be a UAE resident (nationals and expatriates).

-

Not already own any freehold property in Dubai.

-

Purchase a property worth under AED 5 million.

This eligibility makes the program open and accessible for young professionals, families, and expats who want to secure their first home in Dubai.

Financing Options for First-Time Buyers in Dubai

1. Mortgage Loans

-

Loan-to-Value (LTV): Up to 80% for nationals, 75% for expats.

-

Down Payment: Minimum 20–25% of property price.

-

Mortgage Tenure: Up to 25 years.

-

Interest Rates: Competitive fixed and variable rates through partner banks.

2. Developer Payment Plans

Many developers in Dubai offer post-handover payment plans and rent-to-own schemes, allowing buyers to pay over several years.

3. Sharia-Compliant Home Financing

For those seeking Islamic finance options, Ijara and Murabaha plans offer interest-free, Sharia-compliant mortgage structures.

Step-by-Step Guide to Buying Your First Home in Dubai

-

Apply via the Dubai Land Department (DLD) or Dubai REST app to obtain your First-Time Buyer QR code.

-

Get mortgage pre-approval from a partner bank.

-

Browse properties from approved developers using your QR benefits.

-

Reserve your unit by paying a booking deposit (usually 5–10%).

-

Sign the Sales Purchase Agreement (SPA/MOU).

-

Pay registration fees (with EMI options available).

-

Obtain No Objection Certificate (NOC) from the developer.

-

Complete transfer at DLD and collect your Title Deed.

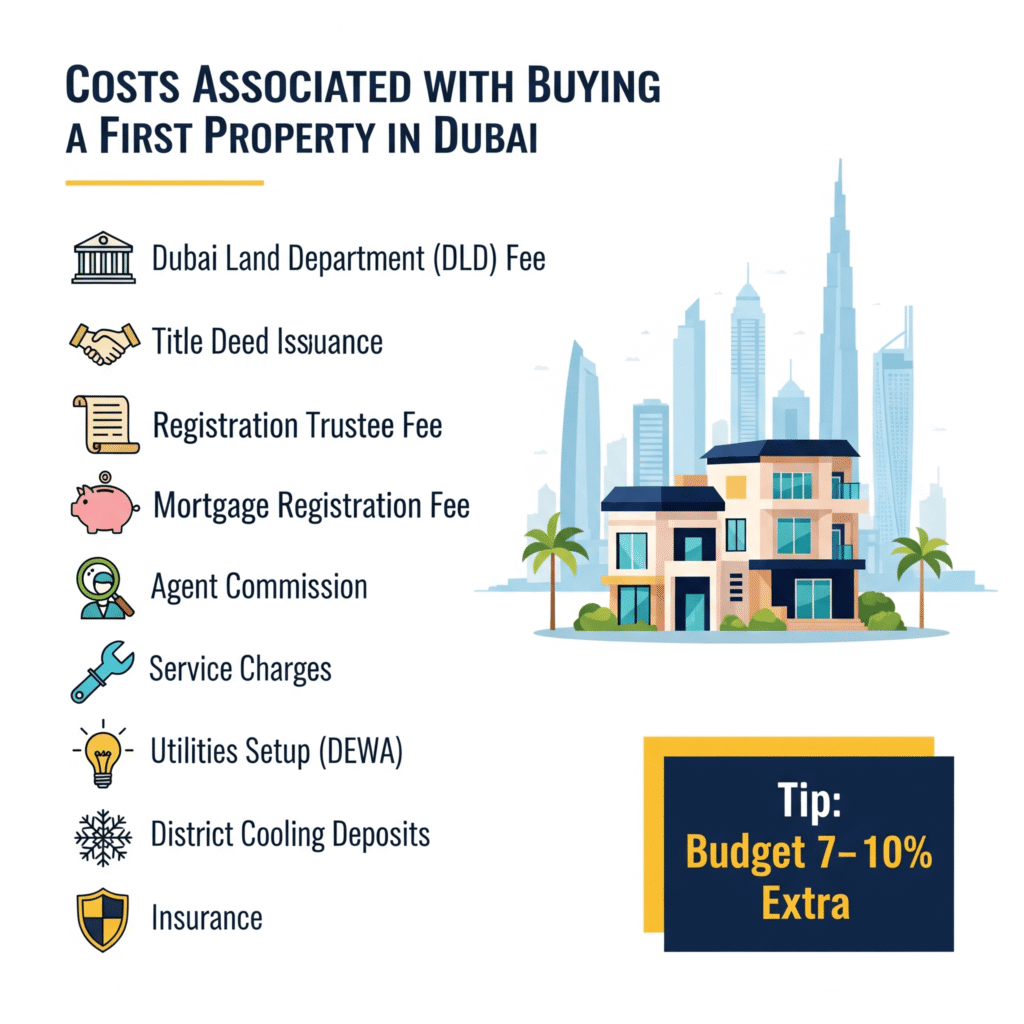

Hidden Costs Every Dubai First-Time Buyer Should Know

When buying your first property in Dubai, factor in the following additional costs:

-

Dubai Land Department (DLD) Fee – 4% of property value.

-

Title Deed Issuance – AED 250–580.

-

Registration Trustee Fee – AED 2,000–4,000 + VAT.

-

Mortgage Registration Fee – 0.25% of loan amount.

-

Agent Commission – 2% of property price + VAT.

-

Service Charges – AED 3–30 per sq. ft annually, depending on location.

-

Utilities Setup (DEWA) – AED 2,000 for apartments, AED 4,000 for villas.

-

District Cooling Deposits & Insurance – AED 1,000–5,000.

💡 Pro Tip: Always budget at least 7–10% extra on top of your property price to cover fees and hidden charges.

Tips for Navigating Mortgages in Dubai

-

Compare banks carefully – interest rates and fees vary significantly.

-

Check eligibility before applying – your credit score and income determine mortgage approval.

-

Use your QR code benefits – many banks offer reduced processing fees and better terms.

-

Consider fixed vs variable rates – fixed rates offer stability, while variable rates may save money in the long term.

-

Hire a mortgage consultant – experts can help secure the best deal and simplify the paperwork.

Why Buy Your First Home in Dubai in 2025?

Dubai continues to attract global investors and residents with:

-

Zero property tax and no capital gains tax.

-

A booming real estate market supported by high rental yields (5–8%).

-

Long-term residency options tied to property investment.

-

World-class lifestyle, infrastructure, and security.

For first-time buyers, this initiative makes owning a home in Dubai both achievable and rewarding.

Conclusion

The Dubai First-Time Buyer Initiative 2025 is a game-changer for new homeowners. By offering reduced fees, flexible mortgage solutions, and priority access to premium properties, Dubai ensures that entering the property market is easier than ever.

With proper planning, knowledge of hidden costs, and smart mortgage decisions, you can secure your dream home in Dubai and make a long-term investment in one of the world’s most dynamic real estate markets.